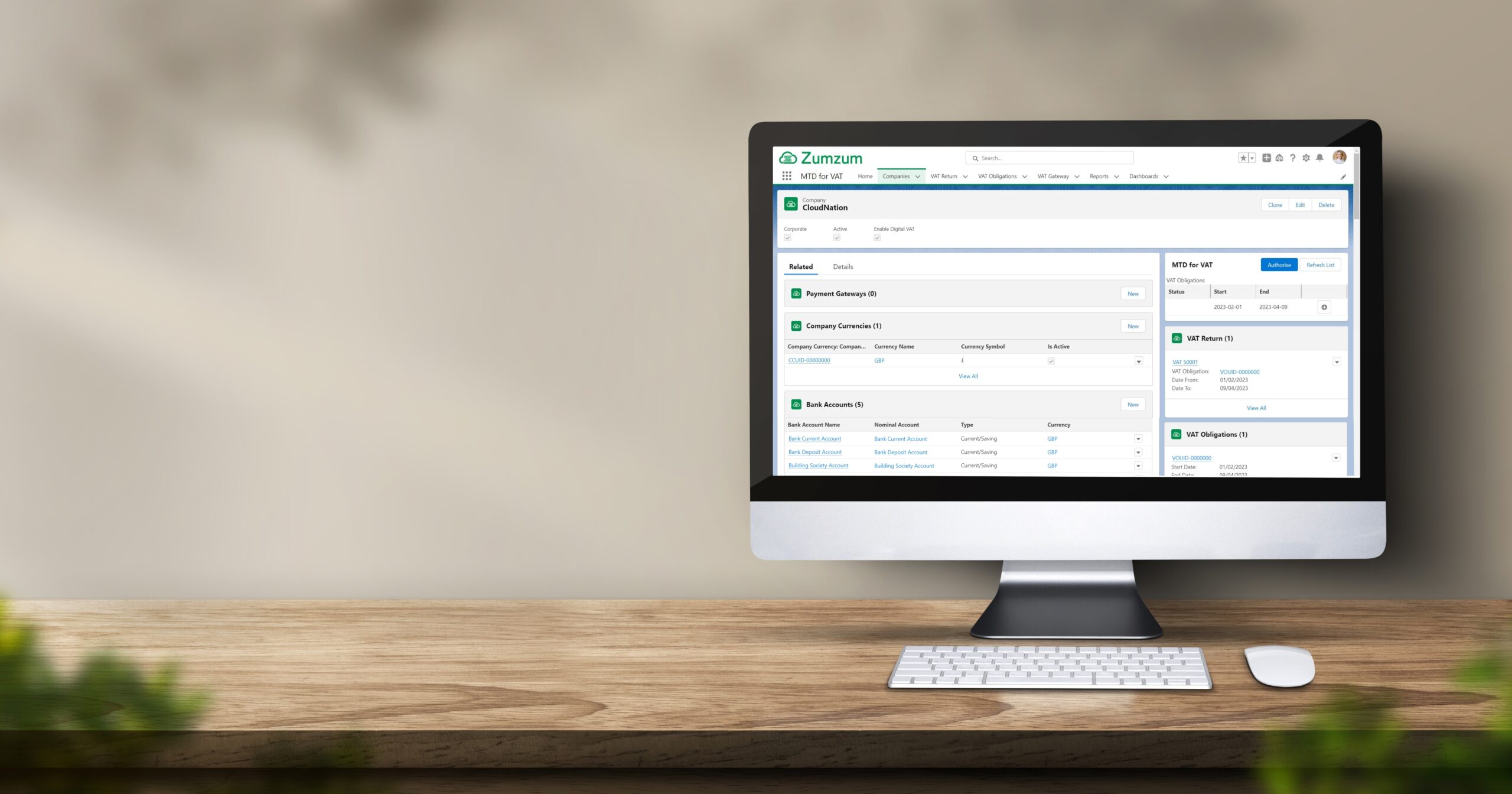

Compliant with

Zumzum Financials.

which makes it simple to submit your returns.

Making Tax Digital

What is Making Tax Digital?

HMRC is transforming the tax administration so that it is more effective, more efficient and easier for taxpayers.

The first stage of HMRC’s Making Tax Digital (MTD) programme focuses on VAT, also known as Making Tax Digital for VAT (MTDfVAT).

From April 2019, HMRC is imposing new requirements on many VAT-registered businesses that need to

- Maintain their accounting records digitally in a software product or spreadsheet.

- Submit their VAT returns to HMRC using a MTD for VAT compatible software.

HMRC have published a VAT Notice about MTD which businesses may find useful.

Latest Updates and Changes To Sign Up Journey

From the 24th of November 2022 businesses no longer need to sign up for MTD on GOV.UK and can no longer use their existing VAT online account. Now, businesses must use MTD-compatible software to keep their VAT records and file their VAT returns. If businesses do not file their VAT returns through MTD-compatible software, they may have to pay a penalty. This means you must act now. You’ll no longer be able to use your existing VAT online account to submit your VAT returns. The only way to file your VAT returns is through Making Tax Digital (MTD) compatible software.

With the requirement announced by the HMRC, we’d like to let you know that we continue to support our clients by removing links to the sign-up journey, helping them to keep digital records, and to submit their VAT returns through our MTD-compatible software. If you have not started Making Tax Digital journey find our HMRC recognized MTD compatible software on GOV.UK by searching for “Zumzum”.

HMRC have published an update about Changes to Sign Up for MTD which businesses may find useful.

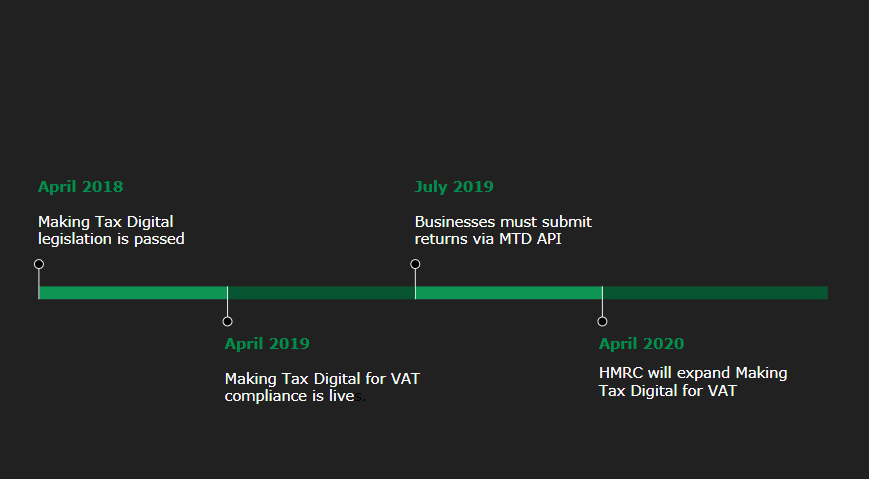

When did Making Tax Digital start?

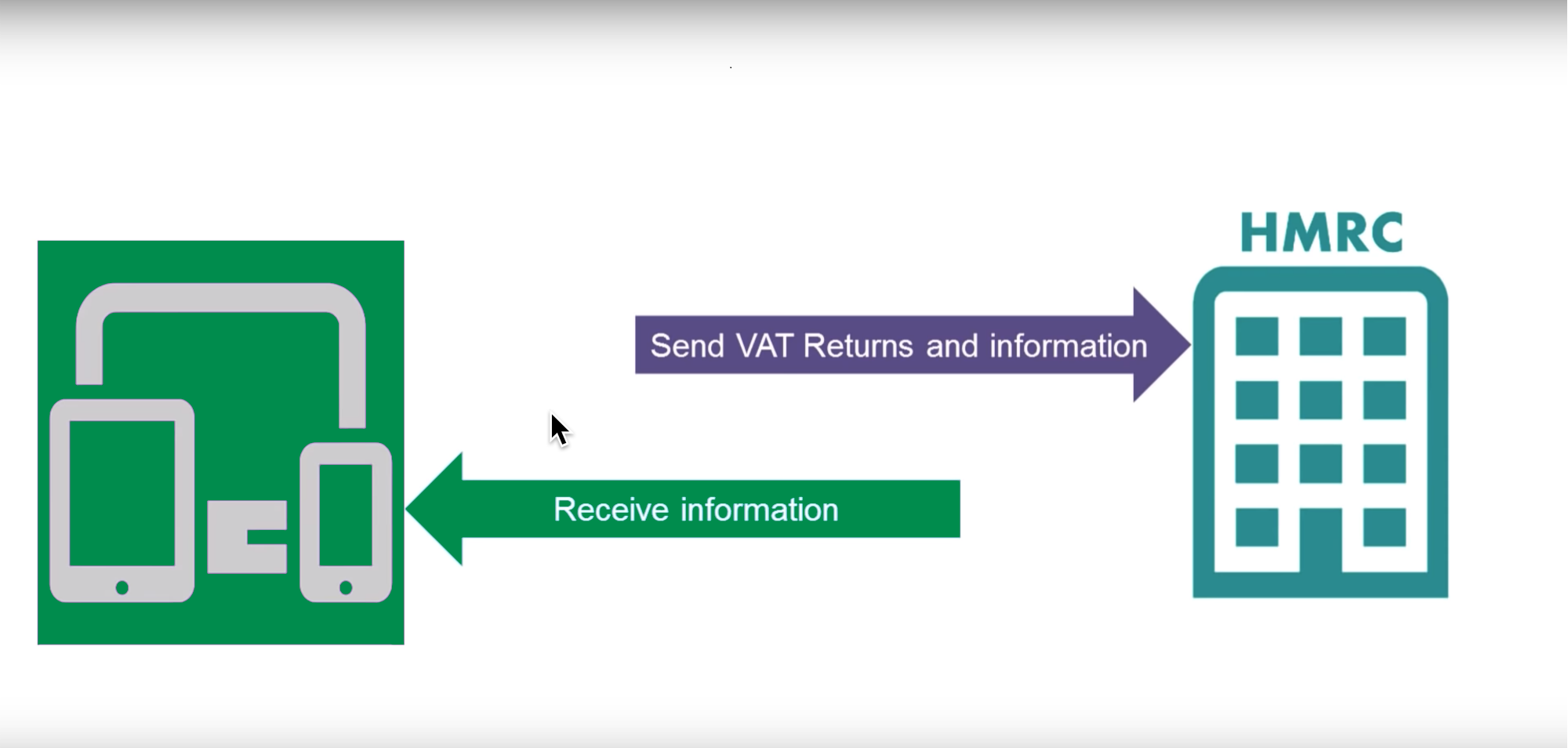

From April 2019, software that prepares a VAT return to send to HMRC must be MTD-compatible. This means that it can integrate with HMRC systems to send VAT returns to HMRC, via the application programmers interface (API) .

From April 2020, data must be exchanged digitally between all software used by a business for VAT. The information contained within the MTD VAT return will be generated by pulling information from the digital records. This information will be the 9 boxes required for the VAT return.

From November 2022, all businesses who have not registered for MTD, have been signing up to MTD automatically unless they are exempt or have applied for exemption. With this latest information, businesses must use MTD-compatible software to keep their VAT records and file their VAT returns.For further information, visit the HMRC site.

What are the benefits of Making Tax Digital?

The move to digital integration will eliminate many of the existing paper-based processes, allowing businesses to devote more time and attention to maximising business opportunities, encouraging growth and fostering good financial planning.

By making it easier to get things right, digital record keeping will reduce the risk of unwelcome and costly HMRC compliance interventions and help businesses to manage their cash flow more effectively.

MTD aims to help businesses get their tax right the first time by reducing errors, making it easier for them to manage their tax affairs by going digital, and consequently helping them to grow. It can help businesses reduce administration workload and frees up time for them to grow their business.

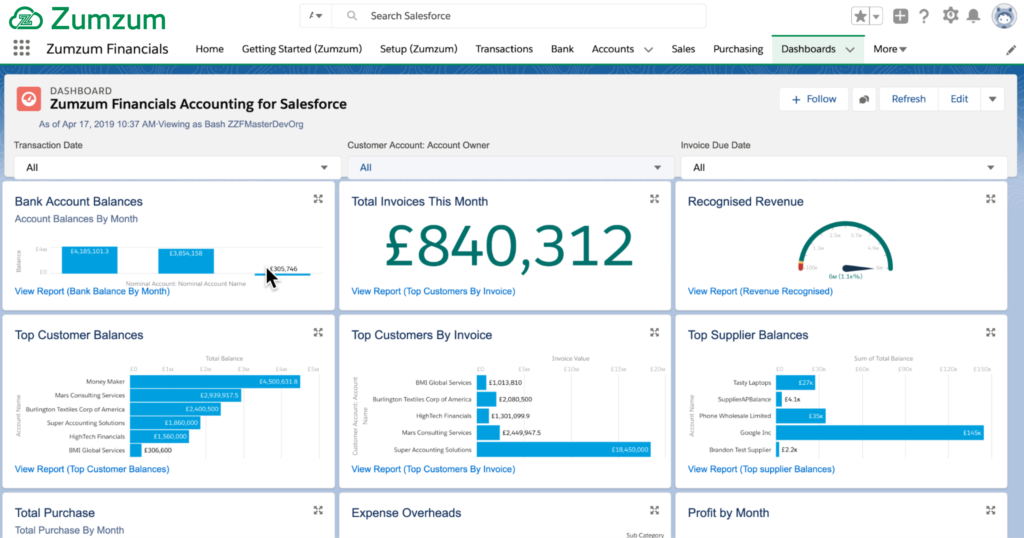

Making Tax Digital with Zumzum Financials

Zumzum Financials is a HMRC recognised, MTD for VAT compliant solution which automatically calculates your VAT return (9 boxes) and the makes it easy for you to submit your VAT return directly to HMRC.

You can find Zumzum listed on the gov.uk site for software which is compatible with Making Tax Digital for VAT.

Leave a Reply